Tax depreciation formula

If the item is worth 30000 and we plan to use it in the next 10 years the formula would be. Youll write off 2000 of the bouncy castles value in year.

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

. To find the depreciation value for the first year use this formula. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. The Formula for Calculating Depreciation Income Tax.

Depreciation in Subsequent Years Cost Depreciation in Previous Years x 1 Recovery Period x Depreciation Method Classification of Property Under GDS IRS provides the. Note that this figure is essentially equivalent. The depreciation for year one is 2000 5000 - 1000.

Divide step 2 by step 3. Under the income forecast method each years depreciation deduction is equal to the cost of the property multiplied by a fraction. If you use this method you must enter a fixed.

Net book value - salvage value x depreciation rate. A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a business will pay taxes on. The unit of production method and the depreciation method are all included in the Companies Act of 2013.

35000 - 10000 5 5000. We note that when depreciation expense is considered EBT is. It can be calculated by multiplying the.

First one can choose the straight line method of. Basis essentially means sunk cost. This means that by listing depreciation as an expense on their.

2 x straight-line depreciation rate x book value at the beginning of the year. Therefore Company A would depreciate the machine at. Total Depreciation is calculated using the formula given below Total Depreciation 2 Straight Line Depreciation Percentage Book Value Total Depreciation 2 200000-10000025 in.

Useful life of the asset. Depreciation 0 million EBIT 14 million 4 million 10 million Scenario B. Tax depreciation refers to the depreciation expenses of a business that is an allowable deduction by the IRS.

80000 5 years 16000 annual depreciation amount. TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate. Annual Depreciation Expense Cost of the Asset Salvage Value Useful Life of the Asset.

2 x 010 x 10000 2000. Depreciation 2 million EBIT 14 million 4 million 2 million 8 million The difference in EBIT. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year.

But if you use the actual expense method the amount you can write off as depreciation is your basis in the vehicle. By using the formula for the straight-line method the annual depreciation is calculated as. Or EBT x tax rate.

This depreciation calculator is for calculating the depreciation schedule of an asset. It provides a couple different methods of depreciation. This means the van depreciates at a rate of.

The Platform That Drives Efficiencies. 30000 x 365 365 x 200 10 30000 x 20 6000. Annual Depreciation Expense 8000 1000 7 years.

Depreciation Schedule Formula And Calculator

What Is A Depreciation Tax Shield Universal Cpa Review

Free Macrs Depreciation Calculator For Excel

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Formula Examples With Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Schedule Formula And Calculator

Depreciation Tax Shield Formula And Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Calculate Depreciation Expense

Depreciation Macrs Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

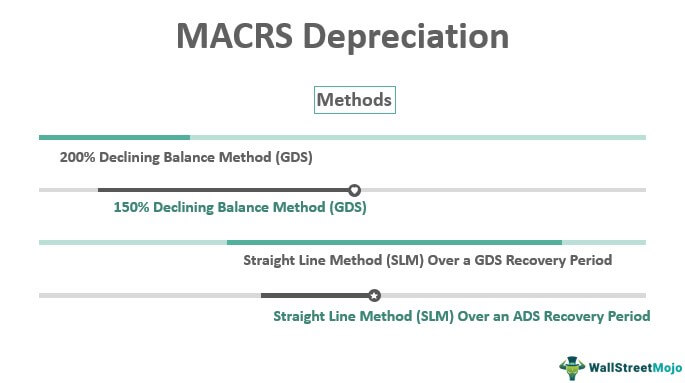

Macrs Depreciation Definition Calculation Top 4 Methods